The $6 Trillion Opportunity: Deconstructing the 5 Layers of the AI Stack

- Debasish

- Jan 22

- 4 min read

The AI revolution is often compared to the California Gold Rush. In the early days, the guaranteed wealth belonged to the "pick and shovel" sellers—the hardware providers. However, as we move into 2026, the economic center of gravity is shifting. We are entering the "Settlement Era," where the most significant value is being captured not by those who build the chips, but by those who deploy them to solve specific, high-value human problems.

To navigate this landscape, we must deconstruct the AI economy into five distinct layers. Using the framework pioneered by Dr. Gustavo Chavez and grounding it in the latest data from the Stanford HAI 2025 AI Index Report and McKinsey Global Institute, this analysis explores where the next $6 trillion will be won.

The Architecture of the AI Stack

1. The Hardware Layer (The Compute Bedrock)

The foundation of the entire stack consists of GPUs, TPUs, and specialized AI silicon.

The Research: According to the Stanford HAI 2025 Index, the "Compute Divide" has widened. The cost to train frontier models has crossed the $200 million mark, with Google’s Gemini 1.5 Ultra estimated at a staggering $224 million in hardware utilization alone.

Economic Reality: While NVIDIA and AMD currently dominate, this layer is characterized by high capital expenditure (CapEx) and cyclical demand. It is the "enabler" layer, but not where the long-tail economic surplus resides.

2. The Infrastructure Layer (The Cloud Power Grid)

This layer provides the virtualization and scaling necessary to run models. It includes the hyperscalers and the specialized "GPU Clouds."

Latest Stats: Gartner reports that by 2026, 85% of enterprises will have used GenAI APIs or deployed GenAI-enabled applications in production environments, up from less than 5% in 2023. This massive migration is fueling a 22% year-over-year growth in cloud infrastructure spending.

3. The Model Layer (The Intelligence Engines)

These are the Large Language Models (LLMs) and Multimodal models—the "brains" of the stack.

The Shift: We are seeing a "Commoditization of Intelligence." Stanford research highlights that the performance gap between proprietary models (GPT-4o, Claude 3.5) and open-source models (Llama 3, Mistral) has shrunk to near parity.

The Trend: As the "intelligence" becomes a utility, the profit margins for general-purpose models are being squeezed, pushing value upward to the application layer.

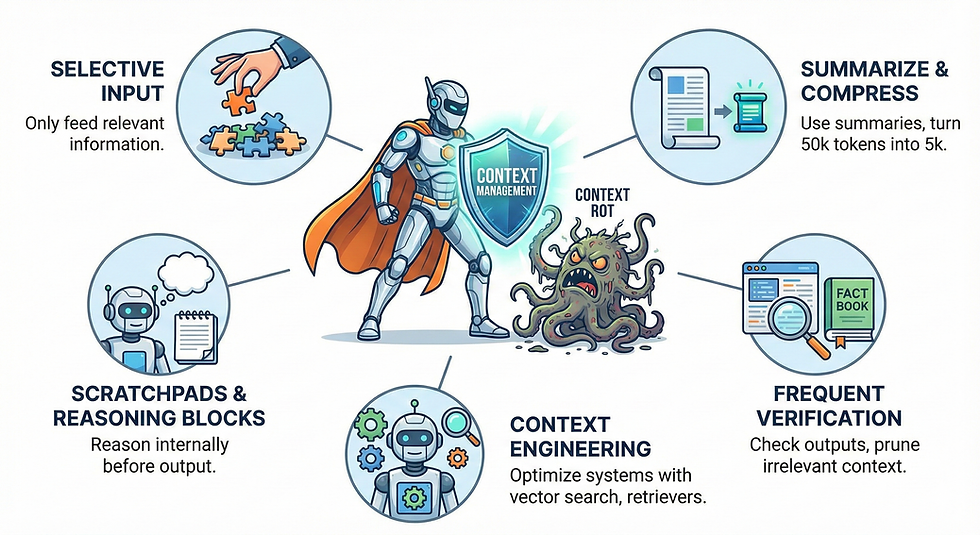

4. The Deployment Layer (The AI Orchestrators)

This is the "plumbing" that makes AI usable for developers: vector databases, RAG (Retrieval-Augmented Generation) frameworks, and MLOps tools.

The Research: This layer is critical for solving the "Hallucination Problem." McKinsey research indicates that enterprises using RAG-based architectures see a 35% higher accuracy rate in domain-specific tasks compared to using raw foundational models.

5. The Application Layer (The Value Capture Frontier)

This is the "Vertical AI" layer. These companies don't sell "AI"; they sell completed work.

The $6 Trillion Thesis: Dr. Chavez identifies that the U.S. service economy spends roughly $12 trillion on wages. Approximately $6 trillion of that is spent on cognitive, non-manual tasks in sectors like Legal, Healthcare, Finance, and Education.

Labor Displacement vs. Augmentation: Stanford HAI data shows that in 2025, AI-augmented workers are completing complex tasks 38% faster than their non-AI counterparts, with a 20% increase in output quality.

Why the Application Layer is the Ultimate Winner

The true opportunity lies in capturing the labor arbitrage. If a company can automate even 10% of a $6 trillion wage pool, they are looking at a $600 billion annual revenue opportunity.

Industry | Addressable Wage Pool (Est.) | AI Productivity Impact (Stanford/McKinsey 2025) |

Legal Services | $350 Billion | 42% reduction in discovery and drafting time. |

Healthcare (Admin) | $1.1 Trillion | 30% automation of billing and patient records. |

Software Dev | $600 Billion | 55% of code now generated or suggested by AI. |

Finance/Audit | $800 Billion | 25% faster compliance and risk assessment. |

The Strategic "Moat" of Layer 5

Unlike the Model Layer, which is a race to the bottom on price, the Application Layer builds "moats" through:

Proprietary Workflow Integration: Once an AI application is woven into a hospital's electronic health record (EHR) system, it is nearly impossible to displace.

Contextual Data Loops: The more a legal AI reviews a specific firm's past filings, the better it becomes at mimicking that firm's specific style—a "data flywheel" that general models cannot replicate.

Outcome-Based Pricing: Top-tier AI applications are moving away from "per-seat" SaaS pricing and toward "per-task" pricing. They aren't charging for software; they are charging for the result.

Conclusion: From R&D to ROI

The era of "AI for the sake of AI" is over. As we look at the data from 2025 and 2026, the winners are those who realize that the Model Layer is a commodity, but the Application Layer is a goldmine. The $6 trillion opportunity isn't about building a smarter chatbot; it’s about capturing the efficiency gains of the global service economy. The "pick and shovel" phase of the hardware layer was the necessary first act. The second act—the one that will define the next decade of wealth creation—belongs to Applied AI.

Comments